BY Blake Saraga & Emily Pasquarelli

Karene Benabou has been working with her husband Oren Toledano to rebuild their home’s basement while juggling work and raising their two kids.

“It was raining really heavily and we had a friend over for dinner that evening,” recalls Benabou. “We were actually talking about the floods in 2017 as Oren noticed our recycling bin was floating across the street and when he opened the door of the mudroom to go pick up the bin, the water started to come in.”

The Toledano family lost everything in their basement as floodwaters from Hurricane Debby swept through the neighbourhood in August, 2024. The water went from the garage and mudroom to the basement.

The top of the brown line marking indicates the height the sewer water rose to during the flood. Photo by Karene Benabou.

After the three feet of sewer water was drained from their home, Benabou started contacting her insurance company, while her husband focused on rebuilding what they had lost.

Benabou estimates they suffered up to $100,000 in damages. After three months of back-and-forth conversations with her insurance company and the bank, the family received $40,000 in compensation.

“Home insurance is complex and varies based on individual circumstances,” says Christina Panzieri, vice-president of Assurance Pro-Secure.

Panzieri recommends comparing insurance providers and policies, followed by having a list of all the valuables in your home, including inventory and important documentation. This way, there’s a bigger chance you’ll get reimbursed for your losses from your insurance company.

Finally, take the long term into consideration and plan for the future. According to Panzieri, insurance is something you hope you don’t have to use but something you need to have.

A view from the entrance of the Toledano residence during the flood. Items were floating across the basement while they scrambled to save valuables. Photo by Karene Benabou.

After paying $10,000 for extraction of all the damaged items, and disinfecting of the stripped-down basement, the Toledano family was left with just about $30,000 to complete the renovations. The renovations included a new bathroom, basement, furnace, washer and dryer and also replacing all the valuables they lost.

Benabou salvaged whatever she could, but her main concern were the items that could never be replaced–memories.

“All I could think about were the memory boxes that were destroyed. My kids were adopted and everything they came with from the hospital documenting the first year of their lives was gone,” says Benabou.

The knick knacks hanging on the wall, along with some childhood photos of Karene’s two boys, Jayden and Ethan, were all that was left of the office and craft room. Photo by Blake Saraga.

More than 2,000 homes were damaged by the remnants of Hurricane Debby and many families have to go out of pocket in order to cover the cost of renovations.

Over five months since Tropical Storm Debby caused Quebec floods, residents are still struggling with costly out-of-pocket renovations. Video by Emily Pasquarelli.

Local government have promised to help residents but according to Benabou, she has not heard anything from the city.

“I took it upon myself to call the minister of security and the minister of municipal affairs to see if they would be willing at the provincial level to find some type of money for those who have experienced flooding. The answer there is from the provincial government, is a clear out, no,” says Alex Bottausci, mayor of Dollard-Des-Ormeaux.

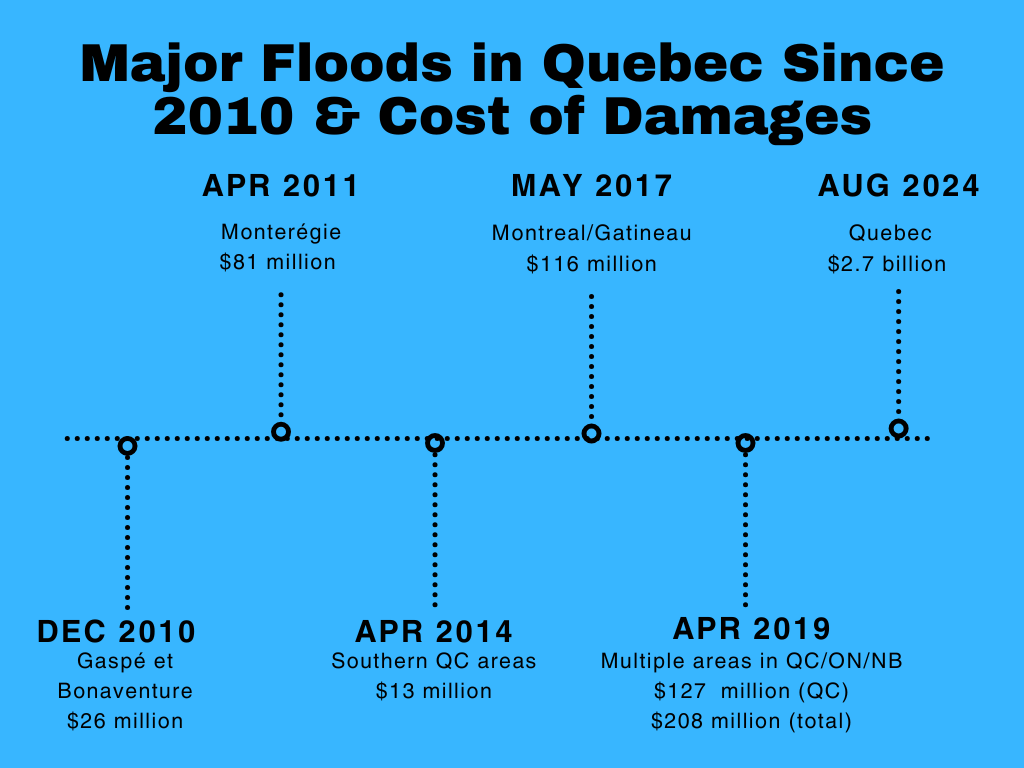

According to the Insurance Bureau of Canada (IBC), the Quebec floods of 2024 is the costliest weather event in the province’s history, surpassing the ice storm of 1998.

Major Floods in Quebec Since 2010 and the cost of damages.Information retrieved from preventionweb.net, ibc.ca and cdd.publicsafety.gc.ca. Timeline by Blake Saraga.

For those who live in flood zones, their cost of home insurance will continue to go up as the risk of flood increases year after year.

“Premiums are generally linked to risk. If you live in an area at risk of water infiltration or sewer backup, the premium you pay is likely to be higher,” explains Anne Morin, public affairs manager at the IBC.

Morin says that water damage is the leading cause in home insurance claims in Canada.

“We recommend that policyholders add endorsements that cover water; these are optional coverages that protect against water infiltration (through the roof, foundation, windows), sewer back-up, and so on,” Morin adds.

According to the IBC, the federal government committed to funding and implementing a national flood insurance plan in their 2023 budget.

Canada’s property and casualty insurance industry is prepared to work in partnership with the federal government in order to launch this program as soon as possible. The program would be cost-neutral and funded by reallocating savings from the residential portion of existing disaster financial assistance.

“The minute there’s rain, the anxiety starts. Everyone starts panicking,” says Benabou.

This was Karene and her husband Oren’s home office/crafting room. Oren Toledano works from home and since the flood, he’s been working at the dining room table. Photo by Blake Saraga.

Now that the flood zones are changing in the spring of 2025, families like the Toledano’s might not be insured the next time the water levels rise, or the sewers get backed up.

“Right now, it looks like our basement will only be finished in the summer since we have so much going on. But what if this summer it rains like that again? I don’t know what we’ll do, but I can’t think like that,” said Benabou.